As traders, the right psychological approach is essential to success. Learn about the psychology behind trading, why it matters, and how to improve your own trading mentality.

What is trading psychology?

Trading psychology refers to the mindset of a trader while speculating on financial markets. This encompasses the thoughts and emotions that a trader experiences, which can be complex and far-reaching. As a trader, your psychology and the way you’re feeling can contribute towards you winning or losing trades. Emotions could cause you to trade riskily and erratically, instead of sensibly and strategically.

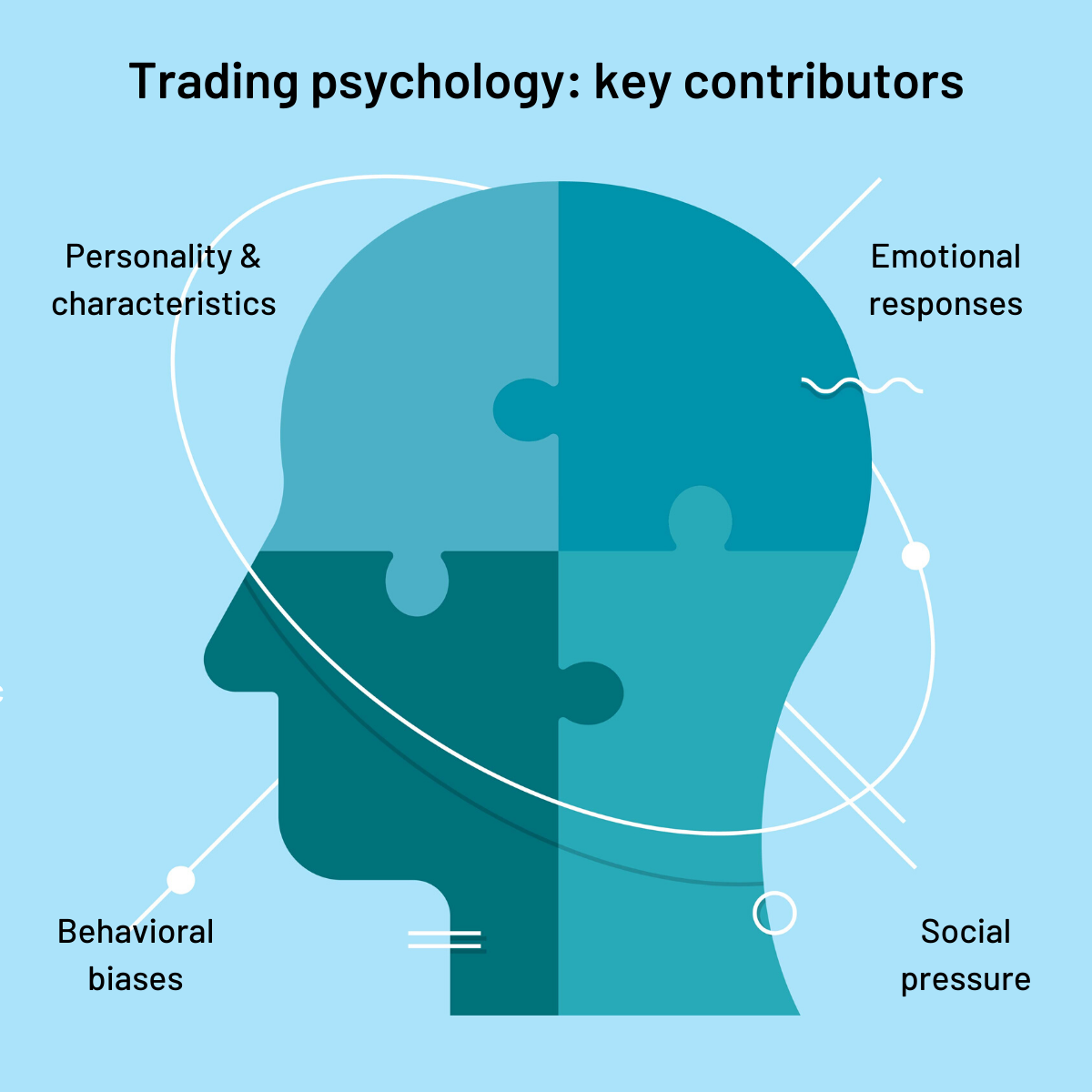

The key contributors to trading psychology

Various factors affect trading psychology. These can be summed up in four categories:

Personality and characteristics are unique traits that can affect the way we react to market movements. Some people might be stubborn; others may be naturally indecisive.

Emotional responses are caused by chemical changes. We can't avoid our emotions but we can learn to recognize them and choose not to act on them impulsively.

Behavioral biases can inhibit decision-making, getting in the way of fact. They can cause people to base decisions on assumptions or emotions.

Social pressure can cause traders to act irrationally out of a 'fear of missing out' or 'herd mentality'. Other people's actions can affect our decisions more than we might realize.

Your own trading psychology will be made up of various aspects from each category. While you might have traits in common with other traders, your psychological makeup is entirely unique to you.

Why do you need to understand trading psychology?

You need to understand trading psychology because it affects your trades and can directly impact outcomes. Our minds are inherently complex places, and thoughts can influence actions, so your own psychology should be a fundamental consideration when defining your strategy. If you take the time to learn about the psychological elements that inform trading, you can begin to understand how to draw on those that will benefit you, and how to eliminate negative emotions to trade more objectively.

Remember, good trading doesn’t mean seeing substantial returns on every trade. It means approaching trading with a solid plan in place and being well equipped to deal with wins or losses that come your way – mentally and financially. A trader who understands their own trading psychology and has assessed their weaknesses and strengths can make better plans for their future trades. This is because plans will account for areas where you know you could fall into the trap of poor decision-making, giving you strategies to execute trades with logic, not emotion.

The psychology of trading and its effects

Trading psychology won’t be the same for everyone as we all have our own personality traits and will experience different emotional responses to situations. People who are influenced by their emotions might be driven to take actions that aren’t logical or sensible. Here are some examples:

Excitement to trade might cause someone to believe unsubstantiated rumors about financial markets.

Boredom or frustration could lead someone to place additional trades with capital they can't afford to risk.

Greed might drive someone to take risks when they could have closed a trade out early and locked in profits.

Pride can stand in the way of acknowledging mistakes, causing traders to make repeated errors rather than learning from past experience.

Even though some of the emotions we experience in relation to trading might be positive (such as excitement), they can cause us to make irrational decisions. It’s much safer to base trades on plans, not emotion.

Trading products and trading psychology

If you are new to trading, or you are finding that you aren’t getting what you want out of your current trades, then it might be time to consider a different approach. The biggest mistakes made by traders are letting losses run or adjusting stops and limits once a trade is live. These are usually emotionally-driven responses to trading situations that deviate from a trader’s plan.

There are ways you can trade to combat this. For example, when trading event contracts, you always know your maximum profit or loss when placing the trade, making this a fixed-risk product. This can help you to understand the trading risk before opening a position, giving you a clearer idea of whether the decision will fit into your trading plan. event contracts can bring some of the enjoyment back into trading too, giving you the excitement of short-term trades with the reassurance of a clearly defined risk. However, event contracts won’t be right for everyone and you should carefully consider any new trades. Make sure they fit in with your trading plan and you have clear, actionable aims with the trades you place.

How to improve your trading psychology

Understand your current mindset

Develop a trading plan

Keep a trading log

Remain calm and accept outcomes

1. Understand your current mindset

Before you can make any improvements, you need to have a starting point. This means you need to understand your current mindset. Begin to process your personality traits, emotions, and the roles they play in your trading decisions. What has driven you to make them – was it fear? Greed? Excitement? Did you respond to a rumor? Perhaps a personal bias made you focus too closely on flawed information?

2. Develop a trading plan

Your trading plan should define your goals and ambitions, as well as setting out the parameters of your ideal trade. This is essential regardless of what strategy you intend to use. Once you have a plan that accurately reflects your aims, stick to it. This will help make your trades strategic decisions rather than emotional responses.

3. Keep a trading log

Successful traders will use a log to track wins and losses. Understanding your trading psychology is an ongoing process and this approach enables you to consider the emotions behind your trades as well as perceiving the various outcomes. Plus, it’s generally good practice to have a clear overview of your finances, in much the same way as a company should be aware of its bottom line.

4. Remain calm and accept outcomes

It’s important to recognize that having a trading plan doesn’t guarantee success or prevent you from losing money – far from it. Trading is a learning curve and even top traders experience losses. This is why it’s important you only trade with capital you can afford to lose. Nobody likes losing, but as long as you can afford it, you can treat your losses as an opportunity to learn – rather than worrying about how you’re going to pay your bills.

Trading psychology: summary

To summarize, understanding trading psychology enables you to make measured, strategic improvements to your trading plan and learn to trade based on more than just emotion and gut instinct. Once you have fully grasped the implications of your own psychology, you can make improvements to develop better trading principles.

Taking the emotion out of your trading will help you to be calm, collected, and strategic; a beneficial mindset for achieving your goals. You can improve your trading psychology by developing strategies that work to your strengths and eliminate weaknesses.

One way to test new strategies is by using a demo account – though you must remember that your mindset when trading with virtual funds is likely to be very different to your psychology when trading with real capital in a live account.

Back to Blog

Back to Blog